First, the Supreme Court ruling in South Dakota v. Wayfair meant that states could require sellers to collect taxes based on sales rather than just physical presence. Most states quickly took advantage and introduced new “economic nexus” laws.

eBay has started collecting sales tax, but it’s a complex situation. Not all states are covered, and some still require sellers to file their own returns.

First, the Supreme Court ruling in South Dakota v. Wayfair meant that states could require sellers to collect taxes based on sales rather than just physical presence. Most states quickly took advantage and introduced new “economic nexus” laws.

Then, many states brought in “marketplace facilitator” laws that require sites like eBay to collect sales tax for third-party sellers, rather than relying on the sellers themselves.

On the face of it, these changes should help simplify sales tax for eBay sellers. They can just sit back and let eBay take care of it for them. But eBay does not collect sales tax for every state where it could be due, and your buyers still care about sales tax – and how much you appear to be charging them – even if you don’t.

- Does eBay charge sales tax on purchases?

- Why is there sales tax on eBay now?

- Do I have to collect tax on my eBay sales?

- Which states is eBay charging sales tax for?

- Are there any states where I need to collect sales tax myself?

- How do I charge sales tax for states without facilitator laws?

- Does eBay add sales tax to used items?

- My buyer is complaining about sales tax. What should I tell them?

- Does eBay have a report showing how much sales tax was charged?

- Do I still need to file sales tax returns for eBay sales?

- Will overseas buyers be charged sales tax by eBay?

- Is there any way to avoid paying sales tax on eBay purchases?

Does eBay charge sales tax on purchases?

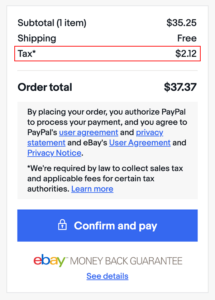

Yes, eBay charges sales tax on many purchases on behalf of the seller, without the seller setting up anything at all. This is to comply with marketplace facilitator laws, and happens automatically during the checkout process. If the buyer is located in one of the many states that have introduced these laws, then eBay will charge sales tax.

Here’s how it looks:

eBay collecting sales tax has been a great relief to many sellers, who no longer have to worry about receiving sales tax from the buyer and then remitting that sales tax to the state.

Why is there sales tax on eBay now?

Buyers on eBay, and other marketplaces, used to have something of a free ride when it came to sales tax. It would only be added if the seller had set up their eBay account to charge sales tax in the buyer’s state. So, most of the time, buyers could avoid sales tax just by purchasing from sellers outside their own state.

The Wayfair decision changed the sales tax landscape by introducing the concept of economic nexus, and paved the way for individual states to pass “marketplace facilitator” laws.

Long story short, states are always on the lookout for sales tax revenue. States use this revenue to pay for things like schools, roads and public safety. And the states realized that they had a better chance to get that revenue from online marketplaces like eBay, Amazon or Walmart than they do from small sellers who might not understand their sales tax obligations.

Another way states have now exercised their new right is by requiring the big marketplaces like Amazon, eBay, Walmart and Etsy, to collect sales tax from buyers on behalf of third-party sellers. The states win, because they receive large sales tax payments from marketplaces. And, in many cases, sellers win because they no longer have to worry about collecting sales tax from buyers in states with marketplace facilitator laws.

Do I have to collect tax on my eBay sales?

That depends. eBay collects sales tax for most, but not all, states. If the buyer is located in a state with a marketplace facilitator law, then eBay will add sales tax to the purchase.

In states with no marketplace facilitator law, like Florida or Missouri, sellers with sales tax nexus (an obligation to collect sales tax) are still required to collect sales tax from buyers via eBay. In those states, it is still down to the seller to set up their eBay account to charge sales tax to buyers, to pay the correct amount to the state, and to file returns.

Bear in mind, however, that the Wayfair decision also changed what nexus means for online sellers. States are now allowed to pass economic nexus laws, and many have done so already. States can set a sales and transactions threshold and if an online seller exceeds that threshold, then the seller is required to collect sales tax from buyers in that state.

The most common threshold is $100,000 and 200 transactions per year in sales into the state but this number varies widely. Therefore, if you have nexus in a state (including economic nexus) and eBay isn’t collecting sales tax on your behalf, then you are still required to collect sales tax from buyers in that state.

Which states is eBay charging sales tax for?

eBay is currently collecting sales tax on orders shipped to buyers in the following states:

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- District of Columbia

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Nebraska

- Nevada

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Tennessee’s marketplace facilitator law is in effect from October 1, 2020 and it’s expected that eBay will begin collecting sales tax on behalf of buyers that day.

Other states could pass marketplace facilitator laws, so check eBay’s page for the latest information.

Are there any states where I need to collect sales tax myself?

The following states do not currently have marketplace facilitator laws so eBay does not collect sales tax on orders shipped to their state:

- Florida

- Kansas

- Louisiana

- Mississippi

- Missouri

If an eBay seller has sales tax nexus in one of the above states, then it is still the seller’s, and not eBay’s, responsibility to collect tax from buyers in the state.

As noted above, Tennessee’s marketplace facilitator law is in effect from October 1, 2020.

How do I charge sales tax for states without facilitator laws?

If you are required to collect sales tax in a state for which eBay does not collect on your behalf, then you should fill out the tax table that eBay provides to let them know how much to charge.

Unfortunately, eBay’s sales tax collection engine is not as robust as many other ecommerce platforms. For example, in most states, a seller is required to collect sales tax at the “point of sale”, which is the buyer’s location for ecommerce sales. This presents a problem because many states have hundreds or even thousands of individual sales tax rates.

Let’s look at an example:

You sell on eBay, you have sales tax nexus in Florida, and you make a sale to a buyer in Florida. Since Florida does not have a marketplace facilitator law, you are still required to collect sales tax from that buyer.

However, if your buyer lives in Miami you’d charge them 7% in sales tax. But if your buyer lives in Tampa you’d charge them 8.5% in sales tax. eBay’s tax table only allows you to pick one rate per state. This means you will either have to undercharge your Tampa buyer (and then owe that sales tax to Florida out of your pocket) or overcharge your Miami customer (and potentially have them complain to customer service or to the state).

Unfortunately, eBay’s very limited tax table is just a fact of life for sellers. You can input an average rate but some customers could still be undercharged or overcharged so this is not a perfect solution.

Does eBay add sales tax to used items?

Yes, eBay adds sales tax to all orders shipped to buyers in states with marketplace facilitator laws. The only exception is for buyers who have a state-issued sales tax exemption certificate and have uploaded it to eBay.

Some items, however, are tax exempt in some states. The rules are extensive and variable. For example, textbooks are exempt in Minnesota, gold coins are exempt in Washington State, and used items sold by individuals (such as garage sales) are exempt in most states.

But this is where eBay’s less-than-robust sales tax engine comes into play. eBay ignores those exemptions and still charges sales tax on exempt items. Currently, there is no way to set an item as tax exempt on eBay.

My buyer is complaining about sales tax. What should I tell them?

While this is ultimately your business decision, you could tell the buyer that eBay is collecting the sales tax and you have no control of when it is charged or how much is charged, so they will need to contact eBay customer support.

Or, if you are charging sales tax in a state without a marketplace facilitator law, you could tell the buyer that the state requires that you charge sales tax and that you are in compliance with state law.

Sometimes your buyer might complain about being charged the wrong amount of sales tax. Unfortunately, as explained above, eBay makes it difficult to charge the correct amount of sales tax to every buyer because they only allow sellers to charge one rate per state, and many states have multiple – even thousands – of tax rates.

In the rare case that a buyer notices they were overcharged sales tax, you can explain eBay’s limited system or issue a refund.

Does eBay have a report showing how much sales tax was charged?

Yes, you can download your order data as a CSV file then open it in Excel or Google Sheets to sort and filter the information however you need. Here’s what to do:

- Go to Seller Hub.

- Click the Orders tab.

- Select “Paid and shipped”.

- Select the period that you want. Note that the maximum here is 90 days.

- Click the “Download report” link.

You can also download data from PayPal, but now that eBay processes some payments itself, the PayPal data may not be complete for your selling account.

You can also use third-party tools such as TaxJar to create easy-to-use sales reports.

Do I still need to file sales tax returns for eBay sales?

You might need to file sales tax returns, depending on each state and your business’s individual circumstances.

If eBay collected sales tax on your behalf, then it depends on how each individual state wants you to handle sales tax. Some states require that sellers still file sales tax returns even if they only sell on marketplaces. Other states say that marketplace-only sellers are not required to file sales tax returns.

But if you collected sales tax from a buyer yourself, by setting up a tax rate in your eBay account, then you must remit that tax to the state and file a return. Also, if you sell via other methods, such as your own online store or via a smaller online marketplace that is not required to collect on your behalf, then you are still required to file a sales tax return.

In general, if you are required to hold a sales tax permit in a state, then you are also required to file sales tax returns in that state. If you have a sales tax permit but only sell through marketplaces which collect sales tax on your behalf, you might be able to cancel your permit. There is a list of states that allow this, but always check with the state first.

Will overseas buyers be charged sales tax by eBay?

Depending on the country, buyers may be required to pay VAT or another consumption tax. However, overseas buyers are never charged US sales tax.

Is there any way to avoid paying sales tax on eBay purchases?

There are a few reasons why buyers might not be required to pay sales tax on an eBay purchase:

- They live in (and are having their goods shipped to) a state with no sales tax

- They are a reseller and have presented a valid resale certificate

- They are a nonprofit and have a tax exemption

eBay allows exempt buyers to upload certificates to prove that they are exempt, and has a useful tool to check which certificates are required. Once eBay has processed the certificate, then they will no longer charge the buyer tax on their eBay purchases.

Mark Faggiano is the founder and CEO of TaxJar, a service built to make post-transaction sales tax compliance easier for Etsy, Amazon, Shopify and other multi-channel ecommerce sellers. Mark’s passion is solving complex problems for small businesses.

This post does not constitute financial or legal advice and should not be taken as such. Always discuss your specific requirements and questions with a qualified professional.

DIGITAL TALK // ENGAGING DISCUSSIONS ON ALL THINGS DIGITAL

Posted on Nov 21, 2023

In the ever-evolving world of eCommerce, data security is paramount.

Posted on Nov 21, 2023

In the ever-evolving world of eCommerce, the way your online store looks and functions can make or break your success.

Posted on Nov 20, 2023

Welcome, savvy entrepreneurs! In the vast landscape of eCommerce, ensuring your payment solutions are top-notch is crucial.

Posted on Nov 20, 2023

In the fast-paced world of eCommerce, providing top-notch customer support is crucial for success.

Posted on Nov 19, 2023

In the digital era, where eCommerce has become the norm, customers expect swift and efficient support whenever they interact with an online store. With the rapid growth of eCommerce, the demand for customer assistance has risen significantly.

Posted on Nov 19, 2023

In the ever-evolving world of eCommerce, operational efficiency can be the key to success. One area where efficiency can make a world of difference is inventory management.

Posted on Nov 18, 2023

Welcome to the world of e-commerce, where the potential for growth and success is vast, but the challenges can be just as significant.

Posted on Nov 18, 2023

In the age of smartphones, eCommerce has become a mobile-driven landscape. Shoppers are increasingly making purchases and seeking support through their mobile devices.

Posted on Nov 13, 2023

The world of eCommerce is a dynamic landscape where businesses have an incredible opportunity to reach and engage with a vast online audience.

Posted on Nov 13, 2023

In the ever-evolving landscape of eCommerce, customer support is a critical aspect of a successful online business. Providing fast and effective assistance to customers is not just a requirement; it's a competitive advantage.